About Us

Blog

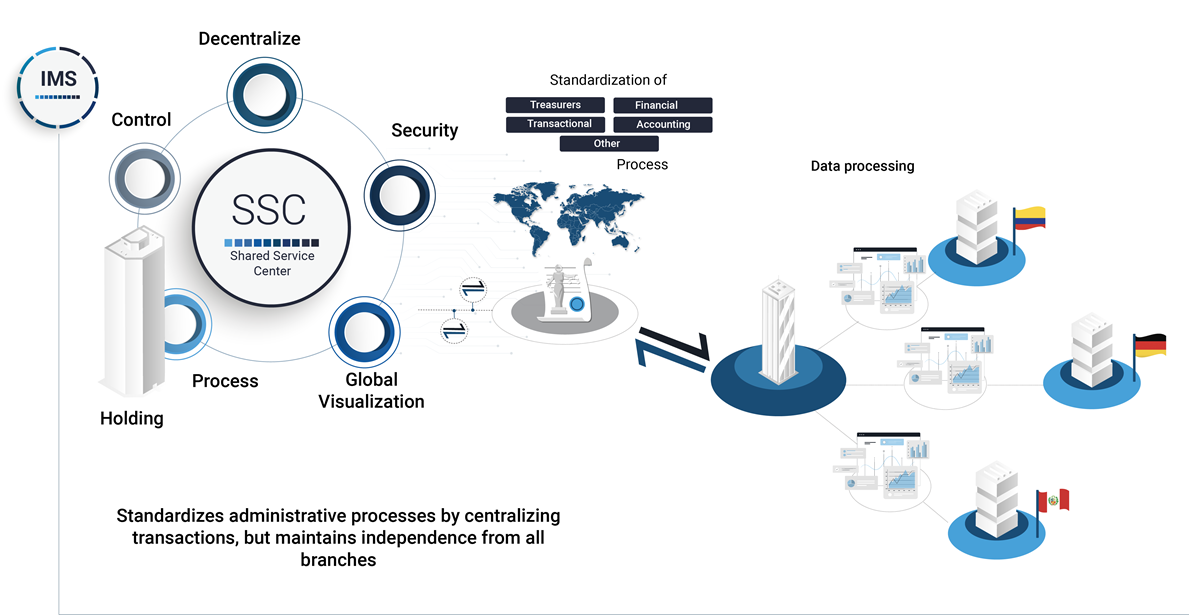

IMS Shared Service Center brings speed and agility into your operations

Increase the quality, professionalism of support and most importantly, create a higher degree of strategic flexibility processes for the treasury department with IMS shared service center.

Introduction

Who should handle the treasury operations of all the business processes irrespective of the various branches and departments? Supporting the enterprise’s internal operations is no longer a hassle for the treasurers. Over decades, shared service centers have been evolving their operating model to provide the best opportunities that optimize people, technology, data, and intelligence.

The shared service centers can offer triple benefits to the corporates commencing from improving service levels, managing operating, and handling all high-level transactional activities when deployed and operated effectively.

Fortunately, SSC is designed new capabilities concerning the outbreak of the COVID-19 pandemic to call a new wave of adapting and re-thinking about the advantage of the significant opportunities from the technology landscape and recent developments. Many businesses have been bidding this new trend, or a new way of working, from what it is called “the future of work,” unlocking the automation potential of the company’s treasury activities.

Evolution of Shared Service Center

For nearly four decades, the shared service models have been evolving and upgrading with ample trends to suffice the business needs right from finance, HR, and manufacturing to concentrate more on their core competencies.

New and standardized processes coupled with the expansion of scope, intelligent automation, offshoring, moving up the value chance to the most acceptable norms, digitalization, to create a frictionless and digital experience, and of course, the robust shared service center connectivity has been accelerated.

YEAR

In the face of a global pandemic, there is a dire need to experience centralized treasury team force operations. The SSC providers with comprehensive BCPs and robust offerings have flavored the requirement very well and helped the corporations leverage the latest technology enablers with operating frameworks and agile service management. Additionally, some current models with over-reliant offerings are improvising the ability to leverage global team efforts across multiple time zones.

Traditionally, by their true nature, shared service models were supposed to be siloed and are less likely to scale and integrate with legacy systems. However, the right SSC models are actually handling the impact of pandemic very well and lowering the risk of the cross-enterprise global effects.

Shared services center is maturing

Dynamic small and large-scale businesses are increasingly incorporating shared service models with the pursuit to support a range of functions. Facing the nextgen of integrated business services and evolving business models, shared services are maturing and modernizing to create more value for the enterprise. Shared services modernization will radically alter the corporate world with simultaneous growth in revenue, reduced operating expenditure, and streamlined management.

To deliver high-value services on an enterprise-wide basis competitively and consistently, breaking the functional silos of SSC has been a common concern. While many SSC providers are helping business enterprises to scale up and knocking down the problems of silos to generate real value for the business, IMS shared service center is achieving operational efficiency saving, end-to-end encryption services, including procure-to-pay, order-to-cash, and record-to-report with governing metrics and data analytics to monitor performance.

The Right Process of Shared Service Center Models

Innovation is not the product of logical thought, although the result is tied to logical structure.

The first element that makes the SSC models secure, robust, and convenient for multinational companies struggling to have full control of their treasury management is the formulation of the right methodology. The right mechanism harness unique ideas from both internal (parent company stakeholders) and external (including service providers, startups, academia, and specialists) ecosystems.

The critical path of this is to evaluate the strategic rationale for the right partnership. At the same time, some SSC partners with the startups for talent augmentation and the third-party providers to facilitate the connections to increase the innovation speed. Shared services centers need to adopt a big bang theory and disciplined approach to rigorously incorporate remedial feedback and track performance continually.

Capitalize on Trends to Turbocharge Your Business Growth

Powering the business processes and helping treasury teams turbocharge their operations to navigate the business successfully towards the right path and help effectively respond to finance future divestiture and cash flow needs. Evolve your shared service strategy with IMS shared service center to increase your responsiveness to growth and take advantage of future business models. Since our IMS works with a multi-entity scheme, businesses can consolidate all the administrative functions in one place regardless of different branches or departments.

Adopt IMS SSC to streamline treasury processing, improve cash management and business resources to achieve higher-quality organizational processes in just ONE place! IMS is the enabler of the shared service center for corporates to drive value and improvement through collected data, increased timeliness of service, and centralized liquidity flow.

We let you focus on what is important for your business.

With IMS shared service center, you can:

- Increase the quality and professionalism of support processes for the business.

- Create a higher degree of strategic flexibility.

- Reduce costs of decentralization,

- And consistently expand the function’s scope and scale.

- Get access to more accurate projections timely.

- Eliminate duplication of services.

- Improve visibility of the cash and data position.

Discover the Spectrum of Possibilities for Treasury Management Operations with ECS Fin!

ECS Fin is an engineering enterprise that specializes in process optimization. We design software solutions with a systems approach to transaction processing. Founded in 1999 as a consulting firm, ECS advised many fortune 100 companies, coordinating business divisions and technology groups.