How to transform your treasury management system with IMS

Undoubtedly, the pandemic and digital transformation era have brought the importance of transforming the treasury management system to ensure working capital transparency and cash visibility. Cash forecasting is normally cited among the most inefficient processes by large and small organizations.

A well-rounded panel consisting of veteran treasures, technologists, CEO, and CFO of ECS fin sat down to discuss their viewpoints on this essential context and came up with a unified solution, “IMS Treasury,” to aid treasurers in forming strategic business growth.

We also identified the key trends impacting the treasury management system to present a robust view for greater visibility and control in the view of headwinds to capture emerging opportunities in a fast-evolving landscape.

After all, incorporating an automated and single system approach in managing the treasury functions offers greater control over the business processes and facilitates end-to-end processing of each payment instruction while improving customer service. Financial institutions and corporates can use IMS treasury to enjoy a consolidated view of their treasury with real-time cash visibility, improved liquidity, and lowered risk.

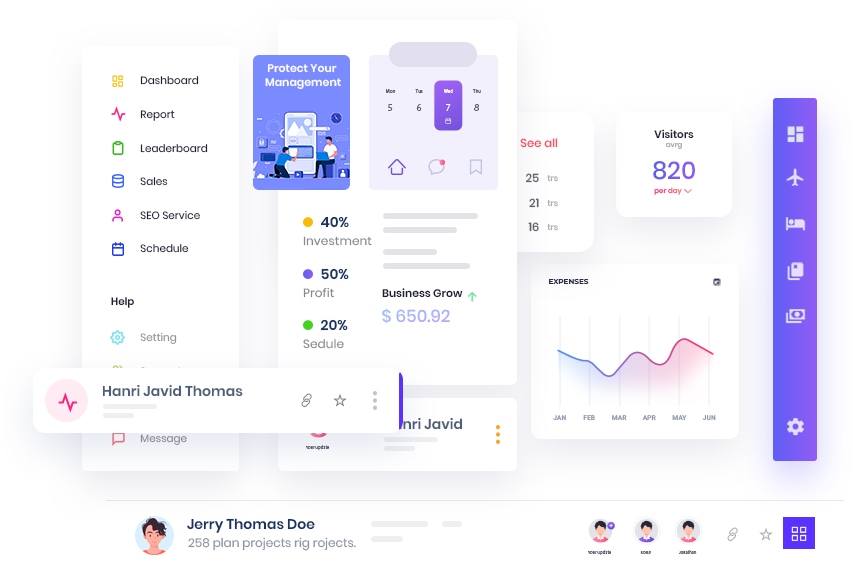

IMS Treasury

A platform is rich with payment processing modules, connectivity services, message libraries, workflow management, and decision trees, offering end-to-end solutions from preparation to settlement and beyond to reconciliation, cash management, and reporting.

Implications for treasury management transformation

As a matter of fact, the scope and scale for transforming the treasury management system call for a thoughtful approach- aiming to mitigate all kinds of uncertainties while setting the stage to capture emerging opportunities. We follow these crucial steps when transforming the treasury management system into a proactive strategic treasury management warehouse. Let’s read about them:

The system should reside between internal applications and all external entities to receive data, do validations, and deliver results to interested parties in desired protocol and schedule. It allows treasurers to realize efficiency gains, share information with multiple banks, and control where it belongs.

Refine and simplify treasury operations by updating payment status and cash positions under one application to provide a consolidated financial view of data. Therefore, minimizing the need for redundant services, fragile data mapping services, and connectivity services that result in data redundancy and unwarranted travel of messages between services.

The solution should be designed to reduce the risk of manual misconfiguration and other errors. It should seamlessly integrate with any processing hub or ERP system, meaning no disruption to a firm's day-to-day operations.

The future of treasury management solutions

As business priorities have changed in this digital era, treasurers need to review their working practices and accelerate the pace at which they adopt new treasury management systems. The Citi Treasury Diagnostics (CTD) survey reported that only 57% of banks and corporates quest for transformative opportunities across their treasury operations and core business plans.

Our Special Blogs

Take a look of aour most recent blog posts to be updated withe most relevant information about the fintech world